Construction Loans

Costs: Pay only the interest while you build

Unique: Loans specialized for construction needs

Experience: Lenders are knowledgeable and can help guide a project

Construction Loans

Lending Overview

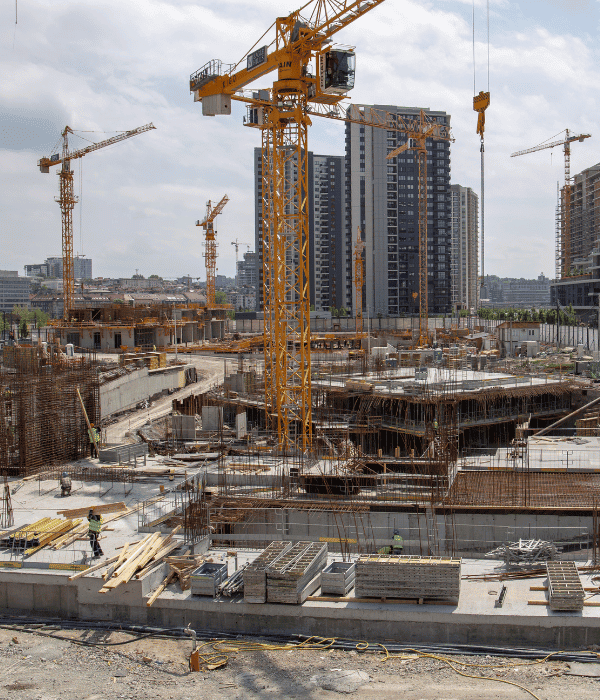

In high-cost markets, smart businesses save money by building instead of buying. Construction loans offer tiered financing that pays in stages based on your progress. If there’s a hitch in your plans, you won’t be stuck paying the whole loan, only the milestones that have been funded. While your project is under construction, you pay just the interest on the loan. Construction loans require the principal when the project is complete. However, you can roll the principal into a long-term commercial mortgage when you use term-to-perm financing. Land acquisition and development loans (A&D) give you the financing you need to prepare land before starting construction. Grading, surveying, inspections, and utility infrastructure can all be handled under one convenient loan. Whether you want to build retail shops, high-rise hotels, or mixed-use properties, there’s a construction loan that will help you do it. Speak with a broker to get matched with the right financing.

Alliance Enterprises

How to Effectively Apply Funds

Construction projects take careful planning and reliable contractors and construction loans are no different. To qualify, you’ll need to show detailed plans and work with approved contractors. You’ll work closely with your lender to determine a set of milestones specific to your project. Once you hit a milestone, you get funding for the next milestone, and so on, until you’ve completed construction. Construction lenders have experience in the industry and know what to look for in a solid plan. They can offer advice and help guide your project in the right direction. Brokers can guide you to the right lender.

Land

Buy and improve land with a land acquisition and development loan from our network of lenders. Prepare by grading, removing debris, installing utilities, and creating roads ahead of upcoming construction. We’ll help you find the best financing for all levels of your project and help you get it done right.

Building

Once your property is ready to build on, talk to our brokers about a construction loan. We’ll get you a great deal on loans for offices, strip malls, warehouses, airplane hangers – whatever you’re looking to build! Pay just the interest while construction is ongoing and save working capital.

Renovations

Construction loans aren’t just for building from the ground up. Use one to tackle renovation projects to hold or flip. No matter what the size of your next business is, we have a loan to cover your costs and get your commercial property looking like new again. Ask us for details!

Learn More

FAQ’s

We believe that the more you know, the better the decisions you make. And in the financing world, better decisions mean lower rates, better terms, and increased profitability.

These FAQs are only the start. Our team is here to answer all of your questions and support you in finding the best financing solution for your unique scenario.

Q. Is my business eligible for a commercial construction loan?

The answer depends on the lender you choose. Requirements vary based on the type of loan you want and how much you need to borrow. You have several options when choosing funding for your construction project, and a broker can help you qualify for the one you want.

Q. Where can I find the lowest-rate commercial construction loan?

You can shop around online for ages looking for the right lender, but only a broker can get you deals you won’t find online. Our brokers build relationships that take years, just to make sure you get the best terms possible on your next construction loan. Ask us to match you with the right lender.

Q. Can commercial construction loans be used for residential property?

The line between commercial and residential isn’t always clear. However, if you’re building multifamily housing or residential subdivisions, a commercial loan can likely pay for it. Ask a broker for more information.

Q. What are the downsides to a commercial construction loan?

Commercial construction loans often have high down payments of 20% or more. You also have to be prepared to pay the entire principal at the end of the loan term. It’s important to plan ahead when seeking a construction loan. Let our brokers be your guide.

Get In Touch

Get Funded

The funding process starts with a short 3 minute online application. Our team will then review your needs and quickly provide you with a custom funding proposal that targets your desired financing types, rates, and terms.